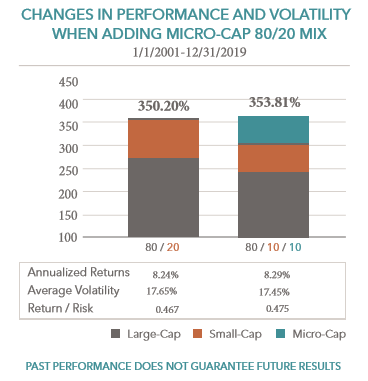

You may be the only investor at the company’s annual meeting or the only attendee on its quarterly conference call. In the micro-cap world, there are no institutional investors or high frequency traders.Ī company may release a positive press release, and its share price won’t react for a day or two. At the same time, high frequency traders are making thousands of trades per day profiting from tiny market anomalies. Hundreds of highly paid buy side and sell side analysts are scouring financials and press releases to profit from the latest news. With most stocks, prices adjust instantaneously for breaking news, whether negative or positive. Third, it’s one of the last areas of the market where it’s possible to develop an informational advantage. Further, it’s usually easy to get management on the phone to run through questions that come up during your diligence process. Most micro-cap companies have one business line and are pretty easy to understand. Second, their business models are simpler and easier to understand. For context, the second smallest decile generated a CAGR of 12.5%, while the largest decile generated CAGR of 9.2%. generated a compound annual growth return (CAGR) of 17.45%, according to the Center for Research in Security Prices ($114MM avg. But from 1927 to 2016, the smallest decile of stocks in the U.S.

Data is a little hard to come by because there are no indexes that adequately track micro-cap stocks (most are too small to be included in the index). There are three main advantages to investing in micro caps.įirst, historic performance has been incredible. Micro-cap stocks helped Peter Lynch generate his 29.2% compound annual return track record while he was running Fidelity’s Magellan Fund. When I talk to a company that tells me the last analyst showed up three years ago, I can hardly contain my enthusiasm.” Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you’ve got a double winner. “If you find a stock with little or no institutional ownership, you’ve found a potential winner. If you buy Coca-Cola at the right price, you might triple your money in six years, but you’re not going to hit the jackpot in two. You don’t buy stock in a giant such as Coca-Cola expecting to quadruple your money in two years. In certain markets they perform well, but you’ll get your biggest moves in smaller companies. How big is this company in which you’ve taken an interest? Specific products aside, big companies don’t have big stock moves. “The size of a company has a great deal to do with what you can expect to get out of the stock.

In his book, One Up On Wall Street, Lynch writes. While he managed billions of dollars, he invested in over 1,000 companies, many of which were micro caps. Peter Lynch was also a fan of micro caps. It turns out, it’s hard to generate superior returns investing in large-cap stocks, even for the greatest investor of all. Why has Buffett’s track record deteriorated? Over the past 20 years Berkshire Hathaway’s compound annual growth rate has only been 9.1%. In recent years, Buffett’s track record has further declined.

From 1965 (when Buffett made his first investment in Berkshire Hathaway) to 2019, Berkshire has generated a compound annual return of 20.2% Pretty amazing, but still significantly lower than his hedge fund’s track record. When he purchased See’s Candies for $25 million, the company was effectively a micro-cap stock.Īfter shutting down his hedge fund in 1969, he switched his focus to Berkshire Hathaway. When Buffett first invested in Berkshire Hathaway, it had a market cap of $18 million. Find out which stocks you should buy this month to make money in this volatile market.

0 kommentar(er)

0 kommentar(er)